social security tax limit 2021

Anything you earn over that annual limit will not be subject to Social Security taxes. This is the largest increase in a decade and could mean a higher tax bill for some high earners.

What Is The Social Security Tax Limit Social Security Us News

This amount is also commonly referred to as the taxable maximum.

. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. Your 2021 Tax Bracket to See Whats Been Adjusted.

Social Security Tax Limit for 2021. The most you will have to pay in Social Security taxes for 2021 will be 9114. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

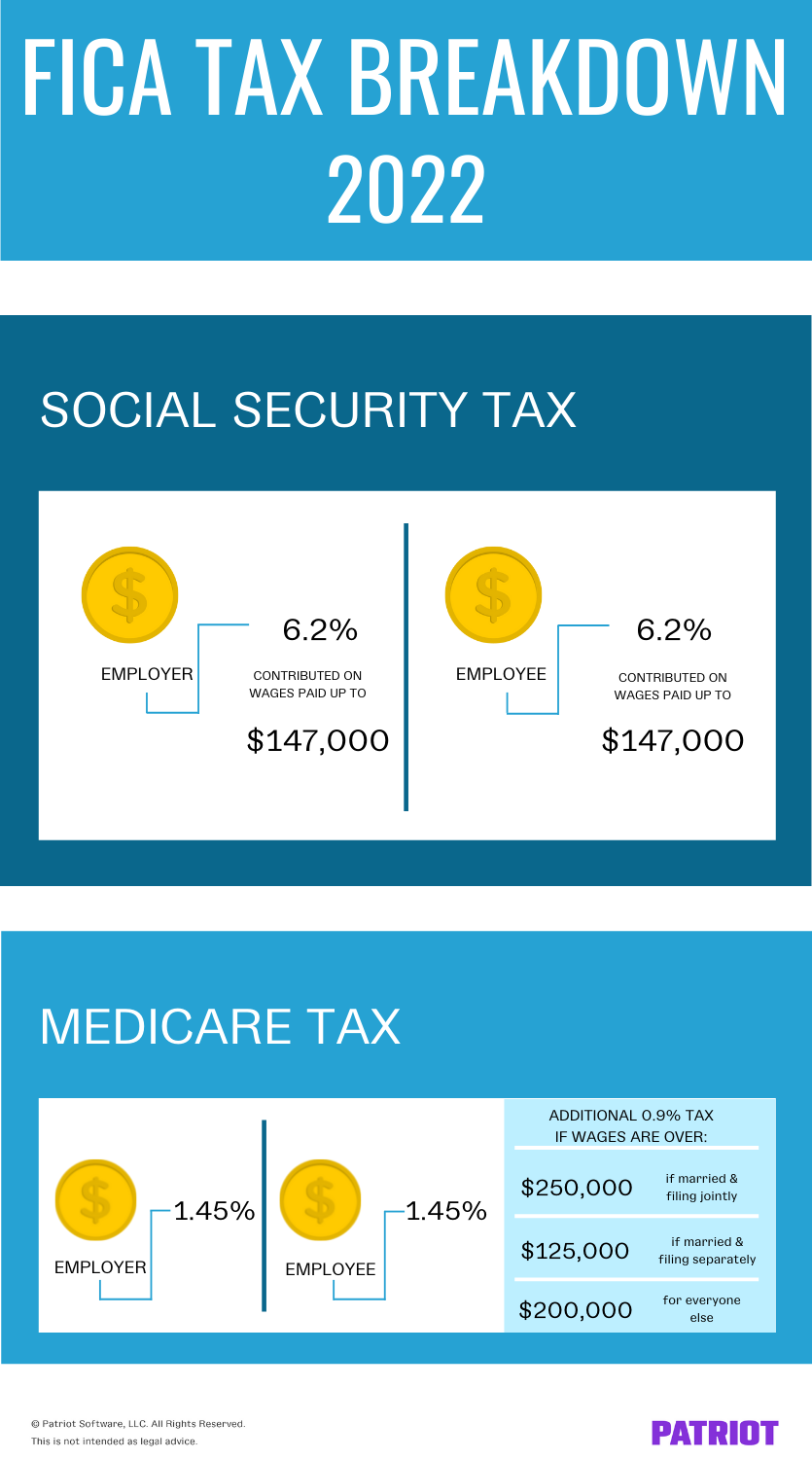

For earnings in 2022. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Hospital Insurance HI also called Medicare Part ANo limit Federal Tax Rate. This also provides a foundation of income for retirees disabled.

Heres what this means. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. The wage base limit is the maximum wage thats subject to the tax for that year.

For 2021 the FICA tax rate for employers is 76562 for OASDI and 145 for HI the same as in 2020. Workers pay a 62. If youre employed by someone else.

62 of each employees first. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. The 765 tax rate is the combined rate for Social Security and Medicare.

Hunter Kuffel CEPF Dec 28 2021. Thats what you will. For earnings in 2022 this base is 147000.

Filing single head of. As of 2021 a single rate of 124 is. Learn about our editorial policies.

The rate consists of two parts. The OASDI tax rate for. Say you earn at least 142800 in 2021.

Fifty percent of a taxpayers benefits may be taxable if they are. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. If that total is more than.

Your employer would contribute an additional 885320. The self-employment tax rate is 153. Least one of the 2020 or 2021 tax years.

Updated 212021 1 2021 Social SecuritySSIMedicare Information. The 2021 tax limit is 5100 more than the 2020 taxable maximum. Between 25000 and 34000 you may have to pay income tax on.

9 rows This amount is known as the maximum taxable earnings and changes each year. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. The Social Security taxable maximum is 142800 in 2021.

Everyone pays the same rate regardless of how much they earn until they hit the ceiling. B One-half of amount on line A. This is collected by the Social Security Administration for social security benefits in the form of payroll taxes.

For 2021 an employee will pay. Discover Helpful Information and Resources on Taxes From AARP. In 2022 the Social Security tax limit is.

The Social Security tax limit. If that total is more than 32000 then part of their Social Security may be taxable. What are the income limits included in the eligibility criteria.

For an individual who was employed in an. A Amount of Social Security or Railroad Retirement Benefits. Worksheet to Determine if Benefits May Be Taxable.

If youre self-employed youll owe 1770720 in Social Security taxes. Fifty percent of a taxpayers benefits may be taxable if they are. Ad Compare Your 2022 Tax Bracket vs.

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. Only the social security tax has a wage base limit. Max OASDI Max HI Earnings Required.

Social Security functions much like a flat tax. We call this annual limit the contribution and benefit base. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages.

Wage Base Limits.

The Maximum Social Security Benefit Explained

What Is Social Security Tax Calculations Reporting More

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Is The Social Security Tax Limit Social Security Us News

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Full Retirement Age For Getting Social Security The Motley Fool

What Is The Social Security Tax Limit Social Security Us News

Social Security Disability Income H R Block

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age