workers comp taxes texas

Texas Workers Compensation laws are complex and impact many areas of an injured workers life and future. Ad Its Fast Easy To Get Workers Comp Coverage.

There is a lot of confusion on the subject of taxes levied on workers compensation benefits.

. The rate is effective April 1 2022 through June 30 2022. Most income earned by Texas residents is taxable and so must be reported on their federal tax returns. Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements.

A remote worker who suffers an injury during. The benefits from workers compensation are typically not taxable in Texas. Workers comp will also pay up to 10000 for burial expenses.

Workers Compensation Laws for Remote Workers in Texas Workers compensation applies equally to Texas remote and on-site workers. Workers Comp Exemptions in Texas Sole-Proprietors and Partners. Household employers in Texas are not required to carry a workers compensation insurance policy however we recommend doing so.

Texas unlike other states does not require an employer to have workers compensation coverage. Limitations of Workers Comp Benefits. Box 12030 Austin TX 78711 512-676-6000 800-578-4677.

These policies pay for medical expenses and lost. Sole Props Entrepreneurs Small Shops Side Hustles. Do you pay taxes on workers comp wages.

DWC has determined that any interest or discount provided for in the Texas Labor Code shall be at the rate of 480 percent. Texas workers compensation insurance gives your employees benefits to help them recover from a work-related injury or illness. The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of.

Minimum Tax Rate for 2022 is 031 percent. It doesnt matter if theyre receiving benefits. To limit or dispute your medical care and.

Subscribing to workers compensation insurance puts a limit on the. You do not need to claim the income benefits from workers compensation you receive on your taxes. As you can see there are limits to workers comp benefits.

However there are some situations when this general rule does not. Sole Props Entrepreneurs Small Shops Side Hustles. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational.

Maximum Tax Rate for 2022 is 631 percent. Workmans comp in Texas can also help employers. The quick answer is that generally workers compensation benefits are not taxable.

The insurance carrier has one goal. Ad Its Fast Easy To Get Workers Comp Coverage. Workers compensation benefits are not subject to either state or federal income tax.

Do you claim workers comp on taxes the answer is no. Texas requires that all businesses involved in projects for government entities carry workers compensation insurance. Workers comp taxes texas.

Texas Department of Insurance 333 Guadalupe Austin TX 78701 PO. Youll receive only a portion. Workers Compensation Texas Law.

You pay unemployment tax on the first 9000 that each employee earns during the calendar year. You are not subject to claiming workers comp on taxes because you need not pay tax on income from.

Texas Non Subscriber How Can Injured Worker S Get Compensation

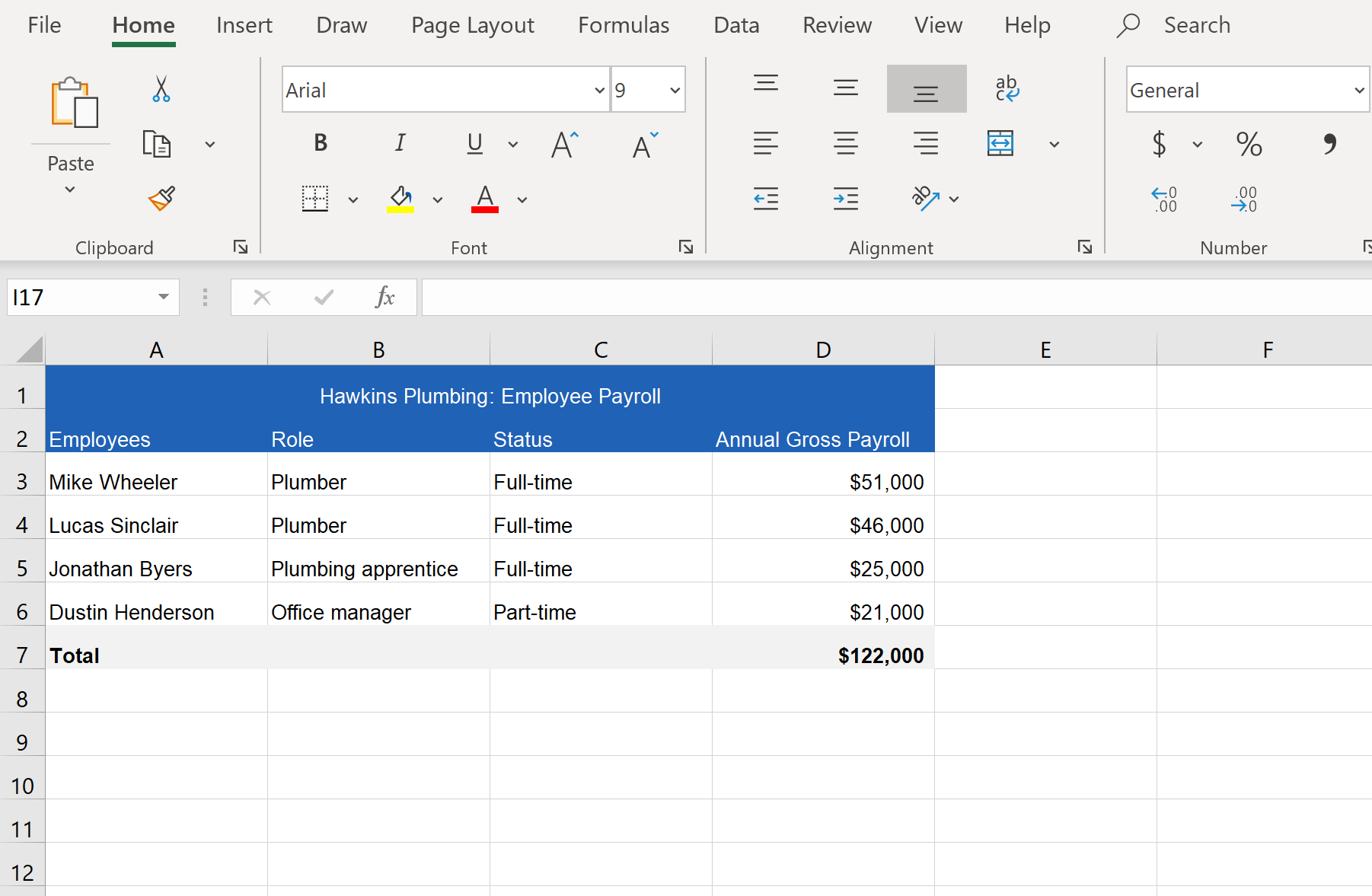

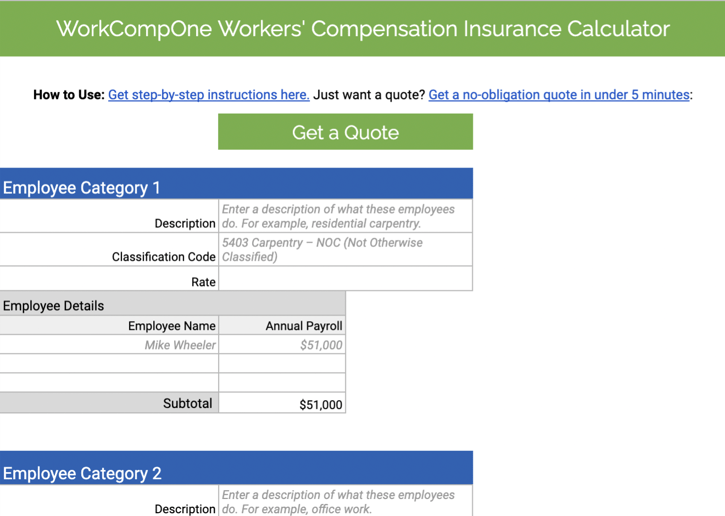

How To Calculate Workers Compensation Cost Per Employee

Lexisnexis Practice Guide New Jersey Workers Compensation Lexisnexis Store

Is Workers Comp Taxable Hourly Inc

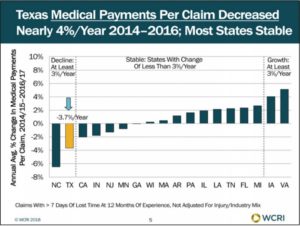

Wcri Texas Workers Comp Medical Costs Per Claim Down Since 2014

Texas Workers Compensation Insurance Laws Forbes Advisor

Workers Compensation Payroll Calculation How To Get It Right

Amazing Spinning Coin Trick Revealed Coin Tricks Magic Tricks Trick

How To Reduce Workers Compensation Insurance Costs Employers Resource

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Pin By Tracy On My Politics 1 Labor Union Pro Union Social Activities

Are The Benefits From Workers Compensation Taxable In Texas D Miller Associates Pllc

Is Workers Comp Taxable Workers Comp Taxes

Is Workers Comp Taxable Hourly Inc

What Is Workers Compensation Article

Light Duty Or Modified Duty Works For Employers And Employees Employers Resource